The COVID-19 pandemic (and government stimulus programs) has left the U.S. banking industry flushed with excess liquidity. While this allows institutions to focus on strategic deployment, the uncertainty of the future and stability of these additional funds requires even more scrutiny on liquidity risk management practices and stress testing.

The Pressures of 2022

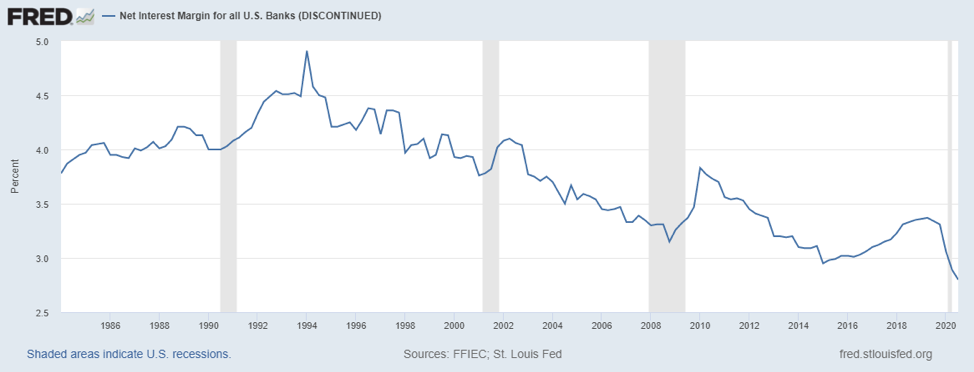

Excess liquidity might relieve any liquidity concerns, but unless it is deployed it is detrimental to profitability, specifically net interest margins. Financial institutions’ net interest margins, a key component of core profitability are at an all-time low. The excess liquidity sitting in overnight funds decreases both net interest margins and capital ratios.

Initially, the industry utilized the excess deposits to strategically lower costs of funds by reducing higher yielding borrowings and time deposits. Simultaneously, institutions began to deploy excess into higher-yielding assets such as loans and securities.

Loan demand increased throughout 2021 but not without its share of risk. In 2022, unplanned global scenarios exacerbate financial uncertainty, such as supply chain issues, inflation, and fears of conflicts brewing with powers such as China and Russia. These issues impacted underwriting and loan decisions. U.S. bank executives told Reuters that as the economy bounced back from the pandemic, demand for loans began to pick up in the first quarter of 2022 driven by consumer spending and companies bulking up inventories. That trend continued during the second quarter, despite aggressive U.S. Federal Reserve interest rate rises sparking recession fears. However, bank executives warned demand could weaken later this year if the worsening economic outlook starts to hurt consumer confidence.

U.S. banks deployed a larger portion of the increase in liquidity into securities purchases. While deemed a more liquid alternative, volatility in the market can cause risk to capital. Regulatory guidance requires banks to hold a buffer of unencumbered highly-liquid assets. The key to managing liquidity is to quantify the optimal buffer to maximize profitability.

Today’s uncertainty heightens regulatory pressures for financial institutions to be prepared and pressures on earnings require that preparation be quantitatively supported. This is where liquidity risk management becomes critical.

What is Liquidity Risk?

Liquidity refers to readily available funds that support the Bank’s ability to fund assets, pay on liabilities and meet other obligations as they come due. Liquidity risk is the possibility the institution will be unable to meet customer obligations because of an inability or perceived inability to liquidate assets or obtain adequate funding at a reasonable cost within a reasonable period of time.

There are two types of liquidity risk. Funding risk is when banks cannot meet their obligations. Funding risk focuses on cash flow forecasts for both assets and liabilities. On the other side, market risk is when assets can’t be sold for a reasonable price, limiting cash flow and causing changes to pricing, collateral, and profitability.

Institutions are vulnerable to both. Understanding the potential risks helps us to understand the dynamic nature of liquidity risk management and to develop action plans that offer a risk aversion strategy to overcome.

The Goals of Liquidity Risk Management

At MountainView Risk and Analytics, as a company that specializes in helping banks and credit unions create processes and procedures for managing liquidity and mitigating risk, there are several necessary elements; 1) to create a sound framework of policy and processes to manage day-to-day liquidity, 2) a system of reporting and measures to understand liquidity trends, 3) an early warning system to identify potential events, 4) a comprehensive contingency funding plan (CFP) to manage through an event and 5) liquidity stress testing.

The goal of liquidity stress testing is to quantify and analyze if the institution has enough funding sources to withstand unexpected market disruptions or unforeseen circumstances. This provides support that the liquidity buffer is sufficient, helps the institution understand risk and exposures to the current business strategies, and confirms action plans. Liquidity stress testing provides the Institution with a forward look into “how to” manage situational risks. Liquidity event fallout can be minimized with early preparation.

The goal is to give the regulators and management comfort in the limits determined for the liquidity buffer. The amount is a function of the stability of the institution’s funding structure and risk characteristics of the balance sheet and off-balance sheet activities. This is supported by estimates of liquidity needs revealed by institutions’ cash flow forecasting and stress testing. The level of buffer is dictated by the stability of funding, concentrations in credits, and other complexities.

As noted, the key to liquidity stress testing is to understand exposure, the results allow the institution to have confidence in a pre-determined liquidity buffer. We must apply assumptions to all facets of liquidity, on-balance sheet, off-balance sheet, and contingency sources, making sure we address market risk. For scenarios that address systemic events, the institution must also address the impact of credit deterioration on cash flows. If the scenario has the institution falling below well-capitalized, it must incorporate regulatory limitations on pricing and access.

There is a catch, the most significant assumption in liquidity stress testing is that of depositor behaviors. In order to forecast expectations of balance changes in a crisis, we must understand our depositor base. This critical assumption requires data analysis. The institution needs to enhance studies for non-maturity deposit behaviors by expanding segmentation not just by product but by insured vs. uninsured, high-rate products, retail vs. corporate, and/or operational. A liquidity event forecasting behavior is very much dictated by insurance and volatility.

The institution must understand their client base such as, who are the large depositors and is there risk to industry concentration. Competitors’ pricing behaviors in your marketplace can drive pricing so it is imperative to understand their strategies as well as your own. As a result of the data analysis, document your methodology and include both empirical basis and qualitative overlays based on the industry’s experience. History will not always repeat itself, therefore overlays are required to differentiate expectations.

Managing your Liquidity Risks with MountainView

The importance of liquidity risk management cannot be understated for financial institutions, so it’s important to choose a risk management company that is fluent in navigating risk and delivering results.

MountainView Risk and Analytics (MVRA) helps banks and credit unions prepare for uncertain times with market knowledge of creating a foundation for liquidity management both on a day-to-day and for validating and reviewing stress testing frameworks. MVRA also has the platform to assist with deposit analytics and develop deposit analysis around liquidity risk elements.

While this article touches the surface of liquidity risk management, MountainView’s Definitive Guide to Managing Liquidity Risk comprehensively explores the topic, providing insight into advanced industry practices to develop a platform of fine-tuned, holistic management strategies that balance the need for liquidity with profitability.

Contact MountainView and talk to one of our liquidity risk management experts to determine how to tighten your processes today, for a better tomorrow.

Written by Chris Mills, Senior Director

About the Author

About the Author

Chris has over 25 years of experience in financial institution modeling and has been leading MVRA’s model validation services and core deposit/loan analyses teams supporting strategic balance sheet and risk management for over 8 years. She brings a wide range of expertise across treasury, asset/liability management, and model risk assessment processes. Experienced with multiple ALM models, she also is skilled in capital modeling, capital markets, liquidity and contingency funding planning, funds transfer pricing, model risk governance practices, and investment banking.