As we mentioned in Part 1 of our SOFR series, some of today’s models don’t have the flexibility to easily incorporate the shift from LIBOR to SOFR, and model owners must find a way to overcome this hurdle. In this blog, we take a look at how SitusAMC’s Valuation & Risk Advisory team took on the challenge.

It is also important to note that any Intercontinental Exchange (ICE) has already officially announced a LIBOR Cessation Date of June 30th, 2023. Any ISDA LIBOR swap contract extending past that date is ALREADY a contract on SOFR, so this is more than just a theoretical exercise. Liquidity in LIBOR swaps has been rapidly deteriorating, so it is imperative that institutions find more reliable sources of market data for curve construction.

For discounting future cash flow, SitusAMC has transitioned from the traditional LIBOR / Swap term structure approach to a term structure that is based on the Securitized Overnight Funding Rate (SOFR). The transition from LIBOR is important as the potential for disruption from the cessation of LIBOR is a pricing risk for corporations with exposure to traditional LIBOR based instruments.

What is SOFR?

The SOFR is the alternative overnight risk-free rate (RFR) for USD . It differs from LIBOR in that it is a secured overnight rate, as opposed to an unsecured term rate. Live SOFR swap rates can be sourced from Bloomberg.

3-Month LIBOR ISDA Fallback Rate

To address the risk that one or more Inter-bank Offer Rates (IBOR) would be discontinued while market participants continue to have exposure to that rate, the International Swaps and Derivatives Association, Inc. (ISDA) formalized fallback provisions that would provide for adjusted versions of the RFR’s as replacement rates. Those provisions were formally triggered on March 5, 2021, when ICE announced that they could no longer reliably source LIBOR data and would cease to publish on June 30, 2023. This rate or spread adjustment was determined on March 5, 2021, and is expressed as a fixed spread adjustment across all LIBOR tenors. The sum of the SOFR swap rate and the spread adjustment (or fallback) will function in place of the equivalent swap rate that was originally used in the valuation of the LIBOR instrument.

It should be noted that the “Spread Adjustment Fixing Date”, i.e., March 5, 2021, is the date on which the spread adjustment was determined. The mathematics supporting the calculation of this spread can be found in the IBOR Fallback Rate Adjustments Rule Book.

The magnitude of this rate adjustment is largely a function of the difference in liquidity, supply and demand, and credit characteristics between the IBOR and RFR markets.

SitusAMC is using the 3 month LIBOR Fallback spread in its derivation of the SOFR discounting curve. The use of this tenor point is in line with:

- The USD Swap convention where the floating leg is based on 3 month LIBOR.

- The rate interface of our MSR valuation model was originally designed for the USD LIBOR / Swap curve. Inputs for the USD LIBOR / Swap curve are common modeling practices.

- Models or model versions whose rate input interface may not specifically accommodate SOFR inputs.

The 3-month LIBOR Fallback spread determined on March 5th, 2021, is 0.26161. The Fallback spread follows the same day count convention as USD LIBOR, which is Act / 360.

Rate Inputs and Day Count Convention

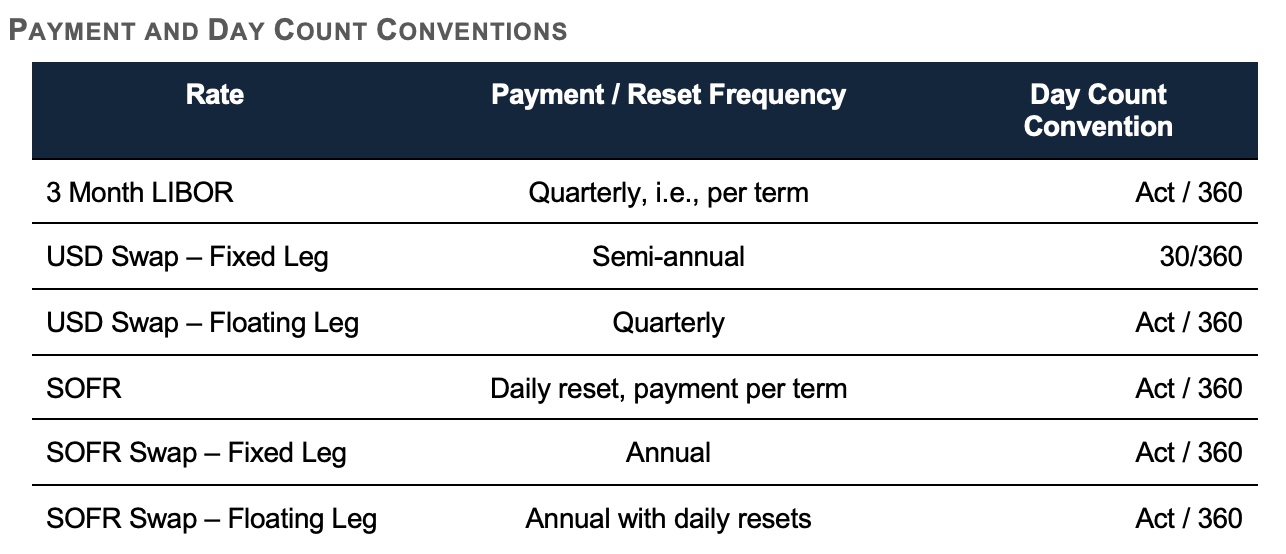

The table below summarizes the typical payment and day count conventions between SOFR and 3 Month LIBOR.

When using rate inputs that are defined for USD LIBOR / Swap payment and day count conventions, SOFR Swap rates have to be converted to this convention for correct rate entry. The 2 to 30-year term points are defined as Constant Maturity Swaps (CMS).

SOFR Curve Calculation

During the current transition period, SitusAMC’s practice is as follows:

- There is no fallback spread adjustment for the 1 and 3-month term points as these are still based on published LIBOR rates. The reason for this selection is that we are not technically trying to construct a SOFR curve. We are trying to construct a LIBOR curve with reliable inputs out past the cessation date.

- The 6 and 12-month term points are based on SOFR swap rates. There is no adjustment for payment and day count convention. The day count convention is the same and the frequency of the payments is dictated by the rate term.

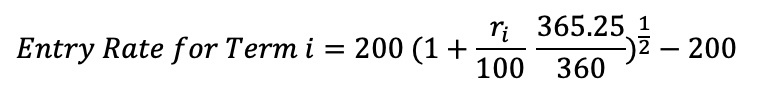

- The SOFR swap rates for the 2 to 30-year term points are adjusted using the formula:

- Where ri is the SOFR rate for term point i.

- This formula appropriately transforms the SOFR Swap Annual, Actual / 360 convention into Semi-Annual, 30 / 360.

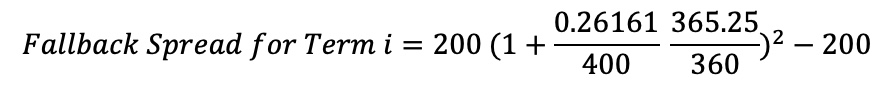

- For term points greater than 12 months, the Fallback spread has to be converted to a semi-annual, 30 / 360 convention. This is achieved using the formula:

-

- This formula appropriately transforms the Fallback spread from the Actual / 360 convention into Semi-Annual, 30 / 360.

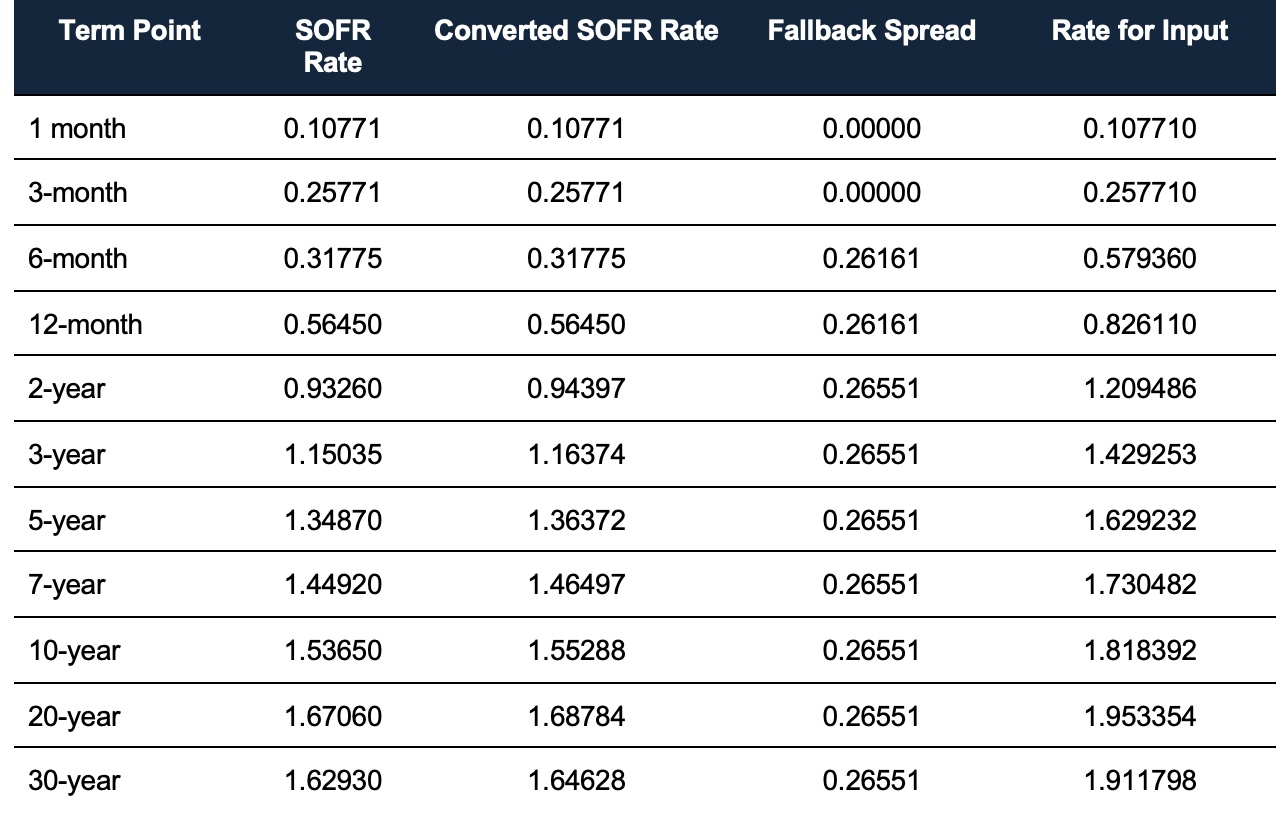

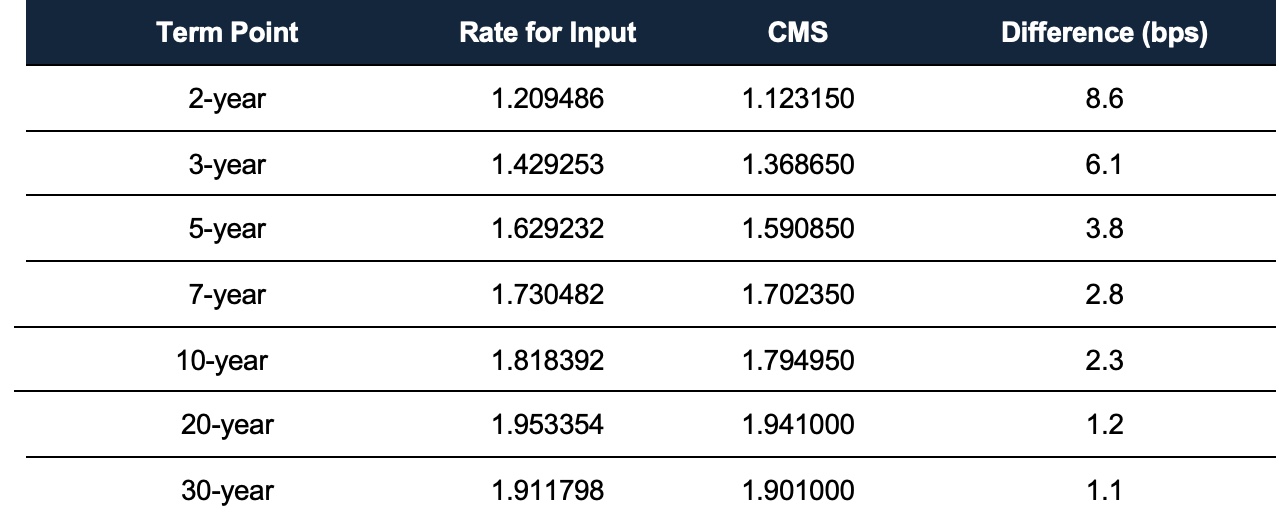

The table below shows the calculated SOFR input rates that were entered into the LIBOR / Swap rate interface.

SOFR Input Curve Benchmarking

As a test for reasonableness, SitusAMC has benchmarked our calculation of the SOFR input curve to the swap counterpart from the 2 to 30-year term points. The table below shows the CMS rates alongside the calculated SOFR plus Fallback Spread rate for input.

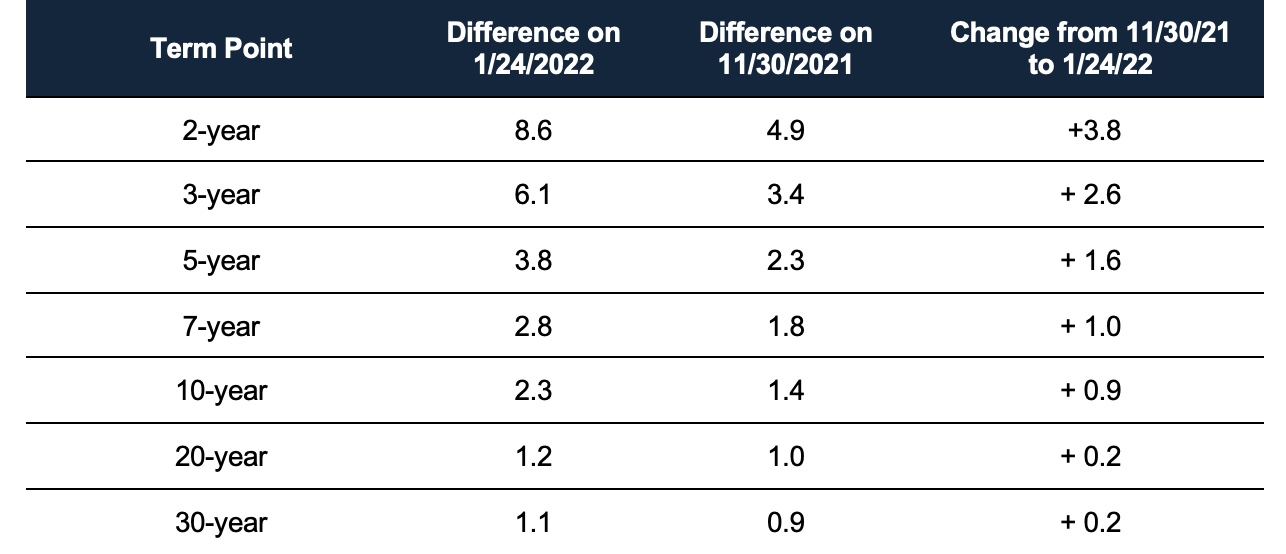

SitusAMC also calculated this difference on 11/30/2021. This difference is shown in the table below alongside the difference on 1/24/2022.

The following was noted.

- The variance over tenor is to be expected. As noted previously, the forward LIBOR curve out past June 30, 2023, is de jure SOFR plus fallback. Any discrepancy in the curves should simply be a function of the expected difference between actual LIBOR and calculated LIBOR (SOFR plus fallback) between now and the cessation date. We have run over $2 trillion in MSR UPB through our model using the SOFR fallback methodology. On every single portfolio we ran, the difference in modeled value was less than one-tenth of one basis point.

- In conclusion, this method will need to be monitored as the market adjusts. One would expect that all models would eventually have an interface for the SOFR curve inputs.

Be sure to explore our solutions page to learn all about our model validation and model risk management solutions today!

Written by Raymond Wong, Senior Vice President, and Michael Riley, Senior Director

About the Author

About the Author

Mr. Wong has over 25 years of experience in the banking industry. Mr. Wong has been providing model validations for 4 years with MVRA. Prior to joining the MVRA validation services team in 2017, he worked for E*Trade as Director of Interest Rate Risk, and prior to that, he was with Everbank Financial Corp for five years as Senior Asset / Liability Manager. Mr. Wong has vast ALM model knowledge including QRM, Empyrean, BancWare, Fiserv, and Polypaths. Prior to ALM, Mr. Wong spent over ten years in the mortgage business doing Mortgage Servicing Rights (MSR) Hedge Advisory, MSR pricing metrics, pipeline risk management, and relative value analysis of portfolio loans. Mr. Wong holds an MBA from the University of Notre Dame (Finance concentration) and a BBA (Finance concentration) from the National University of Singapore.

About the Author

About the Author

Michael Riley leads the operations of MountainView’s Risk Advisory team. In this capacity, he oversees a team of analysts and Investment Advisor Representatives focused on stochastic rate modeling and hedge analytics. He has 15 years of experience hedging MSRs, whole loans, and rate locks. Mike earned a Master’s degree in Mathematics from Tufts University.