Warren Buffet has stated that when conducting a valuation of an asset, projecting interest rates over time is the most important factor. If only we had the power to predict how interest rates changed in the future, so many decisions that utilize interest rates as a component would be simple! However, because we can’t, the key is understanding how our decisions are impacted by future changes in interest rates.

For financial institutions, the structure of the current balance sheet is the critical component in how the institution is positioned for exposure to rate changes. Understanding this exposure provides the blueprint to building a proper foundation to manage Interest Rate Risk (IRR) and is paramount for making sound strategic decisions.

We thought we’d offer you this comprehensive guide to Interest Rate Risk Management to help you make the best decision for your organization.

What Are the Key Drivers of Interest Rate Risk?

By definition, IRR is the potential increase or decrease in earnings and market value generated from fluctuations in market rates.

For starters, it is important to recognize that IRR is inherent in a balance sheet. Net Interest margin (NIM), the primary source of earnings for financial institutions is driven by the spread between the yield on assets earned less the yield on funding paid. This spread relationship changes as yields change due to the mismatch in timing and because indeterminate behaviors can vary depending on changes in interest rates, causing instability in earnings.

The contractual structure of an institution’s loans, investments, and funding behaviors are interrelated, and therefore all directly affect IRR. There are four main types of IRR: Repricing Risk, Options Risk, Yield Curve Risk, and Basis Risk.

Repricing Risk

Repricing Risk is derived from a misalignment (or time gap) between the maturity and repricing of an asset and the source of its funding. For example, if you have an amortizing loan the principal cash flows come in over the life of the loan. However, if the theoretical funding for that loan was a CD, which matures all principal in one month, you would have a funding (and therefore pricing) mismatch between your sources and uses of funds.

Option Risk

Option Risk happens when an instrument’s cash flows are altered due to an exercised option. For example, if contractual loan cash flows are shortened due to a customer deciding to refinance and prepay their loan. The expected principal and interest cash flows are shortened and then the replacement cost is a lower yield because interest rates have decreased. Other examples of options include rate floors or caps, “Step-Up” CDs, and callable investments. Option influences almost always increase interest rate risk and are typically out of an institution’s control.

Yield Curve Risk

Yield Curve Risk is risk that arises from non-parallel shifts in the yield curve, which is typically known as flattening or steepening, depending on the movement. Pricing on instruments is typically calculated based on the term of the instrument compared to a secondary market rate. Changes in the shape of the curve can cause a disconnect in pricing between shorter-term versus longer-term assets. For example, when the curve is steep the spread between a 15-year mortgage funded by 2-year CDs is “wide”, i.e., the cost of funding the 2 year CD is low, which the return on the 15-year mortgage is high. However, if the curve were to flatten the difference in rates is decreased, the spread would “tighten” and NII would decrease, constricting earnings.

Basis Risk

Basis Risk is the risk that different indices with the same repricing frequency do not move in unison. Most often, these two indices would be utilized for similar uses on the balance sheet. For example, if your balance sheet consists of a variable loan where repricing is tied to SOFR, but the funding for that loan is tied to the Treasury curve, a disconnect in correlation can impact earnings.

How financial institutions identify, measure, monitor, and control these risks is critical to an effective IRR management framework.

Your Exposure is Dictated by your Current Balance Sheet Structure

The makeup of your current position, i.e., fixed vs. variable and short-term vs. long-term defines your risk profile.

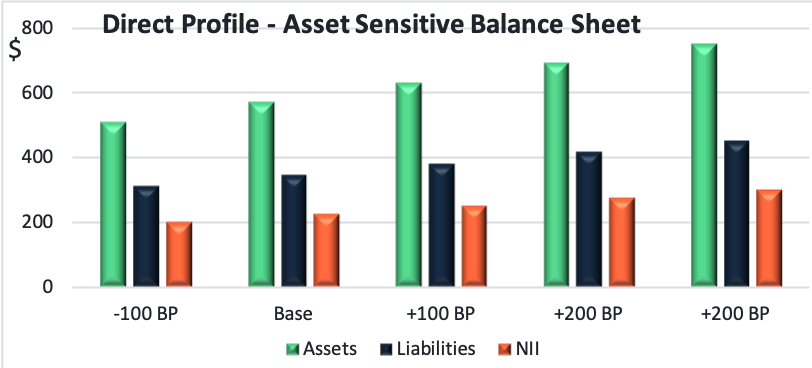

A direct profile is when rate increases results in earnings increase. Assets will reprice faster than liabilities, and changes in interest income dominate. This balance sheet is typically comprised of more variable rate loans or investments and/or shorter-term fixed-rate loans. Funding is less sensitive to rate changes; therefore, it is often comprised of less sensitive non-maturity deposits or longer-term fixed funding.

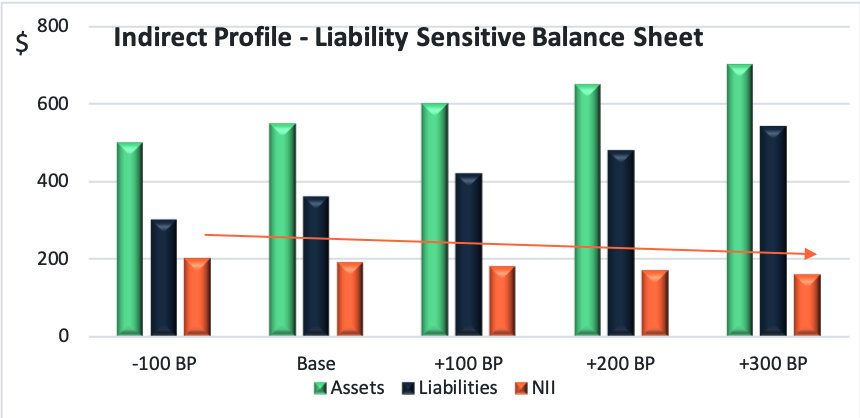

An indirect profile is when rate increases results in an earnings decrease. Liabilities will reprice faster than assets, and changes in interest expense dominate. This balance sheet is typically comprised of fixed-rate loans or investments and longer-term adjustable loans. Funding is more sensitive to rate changes; therefore, it is comprised of more rate-sensitive non-maturity deposits or short-term CDs, as well as overnight wholesale funding.

While the current structure of your balance sheet dictates your profile, new product terms on originations, strategic pricing changes, and funding promotions can slowly reposition your risk exposure. Large asset purchases, changes in funding terms, or off-balance sheet instruments can strategically hedge risk. Strategic decisions about purchases and new product originations can strategically change your risk exposure. These are the main tenets of managing Interest Rate Risk.

Conclusion

As with any decision, there is a risk/reward trade-off. Gaining insight from understanding the key drivers of interest rate risk helps you to align your strategic decisions with the risk appetite of your institution and ensures you maintain robust earnings as the market (and your interest rate risk) ebb and flow.

If you would like to build from the foundations discussed here and further improve your understanding of Interest Rate Risk Management, feel free to download our guide.

Written by Chris Mills, Senior Director

About the Author

About the Author

Chris has over 25 years of experience in financial institution modeling and has been leading MVRA’s model validation services and core deposit/loan analyses teams supporting strategic balance sheet and risk management for over 8 years. She brings a wide range of expertise across treasury, asset/liability management, and model risk assessment processes. Experienced with multiple ALM models, she also is skilled in capital modeling, capital markets, liquidity and contingency funding planning, funds transfer pricing, model risk governance practices, and investment banking.